Trade Logistics in the Global Economy – Top 6 findings and reflects on LPI trends

Singapore Ranks No.5 in Logistics Performance Index 2016

HIGHLIGHTS

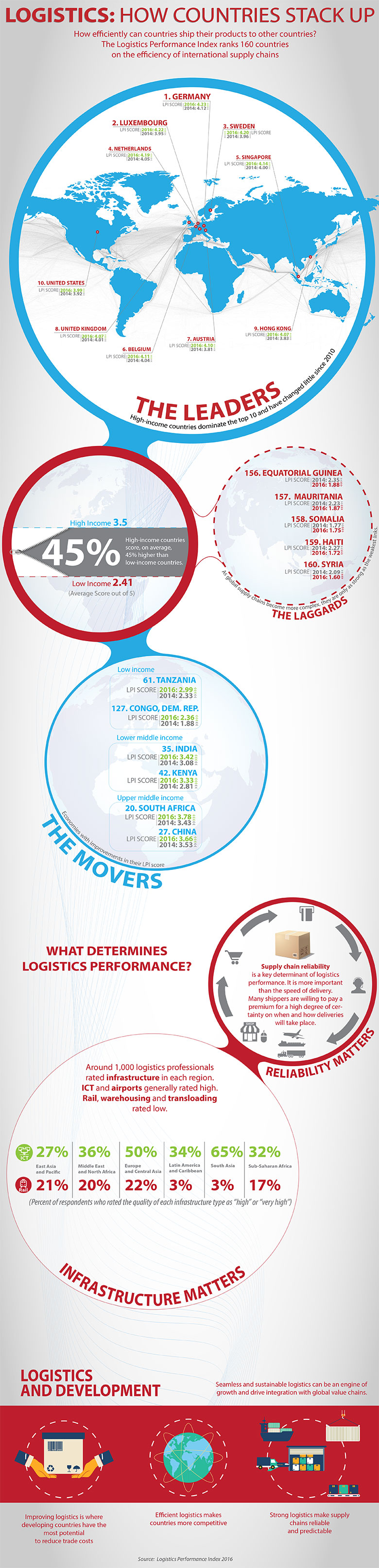

- The 2016 edition of Connecting to Compete scores and benchmarks countries’ performance on logistics. Germany ranked first for the second time in a row, and Syria ranked last. The top performing countries tend to be high-income; countries with the lowest scores tend to be low-income.

- Many factors determine a country’s logistics performance – including infrastructure, regulations, policies, geography, and political economy.

- The Logistics Performance Index, part of the Connecting to Compete report 2016 (Click to download full report), measures the efficiency of international supply chains. It covers 160 countries based on the multidimensional assessment of over 1000 global logistics professionals.

Did you know that 94% of shipments imported into Germany meet the quality standards of global logistics operators, compared to only 40% in Bolivia? Or that importing goods into Georgia requires traders to deal with just one agency, but in Madagascar, traders must deal with 10?

All of these issues, and more, are captured under the broad category of logistics – the methods and procedures a country uses to move goods across borders. Infrastructure, procedures, regulations, geographic characteristics and even political economy issues all play a role in defining the strength of a country’s logistics.

Global trade depends on logistics, and how efficiently countries import and export goods defines how they grow and compete in the global economy. Countries with efficient logistics can easily connect firms to domestic and international markets through reliable supply chains. Countries with inefficient logistics face high costs – both in terms of time and money – in international trade and global supply chains. This can severely hamper a nation’s ability to compete globally.

“There is no trade without logistics and poor logistics often means poor trade,” said Huxiang Zhao, President of the International Federation of Freight Forwarders Association. “Logistics performance requires the integration of many elements throughout the entire supply chain.”

With so many factors involved in a country’s logistics, it can be difficult to conduct comparisons across countries. This is why the latest issue of the World Bank Group’s bi-annual report Connecting to Compete 2016: Trade Logistics in the Global Economy includes The Logistics Performance Index (LPI), which captures critical information about the complexity of international trade. The index scores countries on key criteria of logistics performance, including border clearance efficiency, infrastructure quality, and timeliness of shipments, among others. For the second time in a row, Germany is the top performer, while Syria ranked last. Singapore ranked No.5 in LPI 2016.

(Infographic – Logistics: How Countries Stack Up, view in higher resolution)

“Looking back across past editions of the LPI, we have been able to demonstrate topolicymakers that logistics matter to all countries, regardless of income level,” notes Jean-François Arvis, Lead Specialist for Trade & Competitiveness at the World Bank Group and co-author of the report. “Today, logistics are increasingly complex as they incorporate more areas such as green logistics, jobs, or city distribution.”

The scores are based on two sources of information: a worldwide survey of logistics professionals operating on the ground (such as global freight forwarders and express carriers), who provide feedback on the countries in which they operate and with whom they trade; and quantitative data on the performance of key components of the supply chain, such as the time, cost, and required procedures to import and export goods.

” The Logistics Performance Index helps policymakers visualize how their country is performing in comparison to its peers in terms of moving goods between countries, connecting with global supply chains. The LPI informs policy makers about areas that need improvement and emphasizes the importance of creating seamless supply chains. “Says José Guilherme Reis, Trade Practice Manager for the World Bank Group’s Trade & Competitiveness Global Practice.

Key Findings of the report

- Top performing countries have remained relatively consistent since 2010. The top 15 performing countries have changed only marginally since 2010, and include dominant players in the supply chain industry, such as Germany, the Netherlands, and Singapore. The 2016 report ranked Germany the highest and Syria the lowest. Countries at the bottom of the rankings are either fragile economies affected by armed conflict, natural disasters, political unrest, or geographic constraints.

- The “logistics gap” between more and less developed countries persists. High income countries, on average, score 45% higher on the LPI than low-income countries. In previous editions of the report, the lowest performers appeared to be catching up. However, this trend reversed in 2016, and the gap between the top ranked countries and those at the bottom of the scale widened.

- Supply chain reliability continues to be a major concern for traders and logistics providers alike. Among the top 30 countries in the LPI, approximately only 1 in 10 shipments fail to meet quality criteria in the top 30 performers. Among the bottom 30 countries, nearly three times as many shipments fail to meet these standards.

- Income alone does not explain performance. The willingness to reform and implement good practices and policies can have a direct impact on fluidity of crossborder shipments. Examples like the Single Customs Territory in the East African Community, which allowed for steep reductions in clearance times along regional corridors, can be good examples of how such policy changes can have dire positive impacts on supply chain efficiency.

- Infrastructure continues to play a big role in assuring basic connectivity and access to gateways for most developing countries. In all income groups, survey respondents reported that infrastructure is improving. However, countries in the bottom quintile of LPI scores are improving at a much slower pace than those at the top of the scale. Regardless of income levels, logistics professionals are the most satisfied with ICT infrastructure and the least satisfied with rail infrastructure.

- Border management reforms are a serious concern. Countries at the bottom of the rankings continue to struggle with paperwork and long delays. This is especially true for low- income economies constrained by geography such as landlocked developing countries.

“The LPI plays an important role in raising awareness, and is often the starting point of a policy dialogue,” says Daniel Saslavsky, trade specialist and co-author. “With the LPI and other tools, we are continuously supporting the evolving reform process.”

Source: WorldBank