China’s e-commerce soft spot: Logistics

Thanks to China’s e-commerce boom, the country’s package-delivery business has been growing at 30 percent a year. On the most recent Single’s Day—an online buying fest that takes place every November 11—consumers ordered 680 million packages, across all Chinese websites, that needed delivery.

That’s good news with a nagging downside: growth is eroding margins for many e-commerce players as they struggle with the basics of moving so many goods. Alibaba, for example, has slated $16 billion for future logistics investments, both to increase its market reach and to improve the reliability and speed of delivery. (Alibaba owns T-mall, which sold $150 million in merchandise in just over a minute during Singles Day 2015 and ended it with more than $13 billion in total sales.)

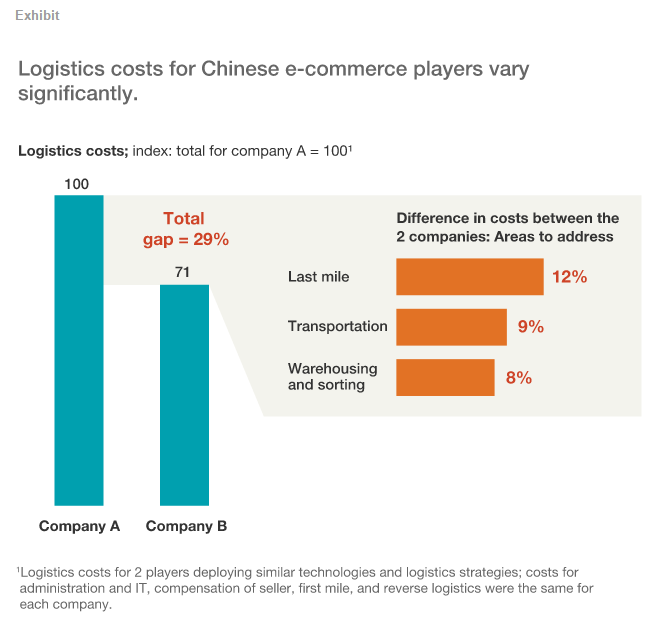

E-commerce companies are trying creative solutions, such as investing in online-to-offline business models and self-pick-up strategies, which shift more of the last-mile delivery costs to purchasers. They’re also automating their warehouse operations. The results so far are mixed: McKinsey research shows wide variations in logistics costs among e-commerce players deploying similar technologies and logistics strategies (exhibit)

In our experience, companies should start with the basics: grinding out logistics gains by standardizing processes and applying lean practices all the way from the supply chain to the management of returns. Our research shows that certain improvements—such as more standardized packaging, better route planning, optimization across transportation modes, and tracking returned products—could lower logistics costs by 30 percent, without significant investments in new technology or business models.

Source: Mckinsey